In South Africa, where sophisticated financial scams are common, recognizing a Ponzi scheme is vital for investors. Watch out for unusually high yields without clear explanations, constant pressure to invest quickly, or the need for continuous new investors. Conduct thorough independent research and consult regulated financial advisors to protect against falling victim to these fraudulent investments in SA.

“Unraveling the insidious web of investment fraud, particularly the persistent threat of Ponzi schemes, is essential for South African investors. This article serves as a comprehensive guide to understanding these fraudulent structures and equips readers with crucial knowledge on how to recognize and avoid them.

We’ll explore the fundamentals of Ponzi schemes, from their historical trajectory to their global impact, offering insights into their defining characteristics. Furthermore, we’ll delve into specific red flags, regulatory measures, and practical tips for investors, empowering them to navigate the market with vigilance.”

What is a Ponzi Scheme?

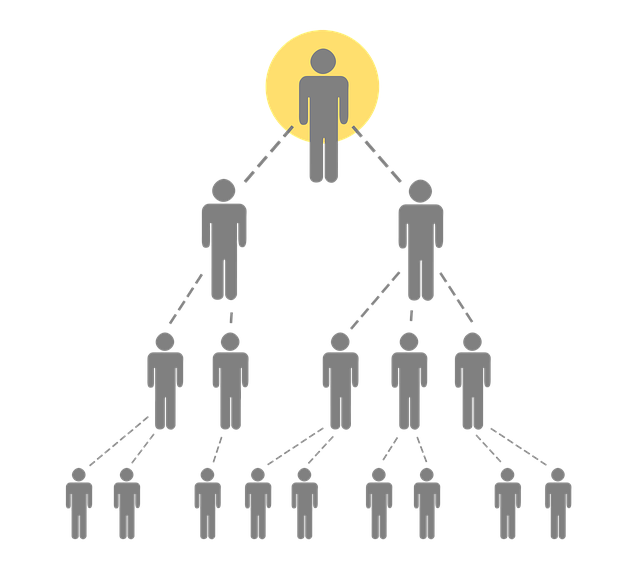

A Ponzi scheme is an investment fraud where returns are paid to existing investors from funds contributed by new investors, rather than from any actual profit earned. This creates the illusion of a successful and lucrative investment opportunity. In South Africa, as in many other countries, these schemes can be particularly enticing, offering seemingly high returns with little risk. However, they are designed to fail in the long term, as they require an ever-growing number of new investors to sustain them.

To recognise a Ponzi scheme in South Africa, look out for several red flags. Unusually high returns with no explanation of how they were achieved are a common indicator. If the investment opportunity requires continuous new investments to pay existing investors, it could be a Ponzi scheme. Additionally, pressure to invest quickly or threats of missing out on opportunities can be tactics used by fraudsters. Always verify the legitimacy of an investment opportunity through independent research and consultation with regulated financial advisors.

– Definition and basic structure

In South Africa, like many countries worldwide, investors are unfortunately susceptible to sophisticated financial scams, with one of the most prevalent being Ponzi schemes. A Ponzi scheme is an investment fraud that promises high returns with little or no risk. The basic structure involves a few initial investors who receive substantial returns, attracting new investors with the belief that their money is being used for productive investments. However, in reality, the funds from new investors are used to pay off the initial investors, creating a false sense of profitability. This fraudulent practice often targets the unsuspecting public, especially during economic downturns when individuals are eager for alternative investment opportunities.

To recognise a Ponzi scheme in South Africa, one must be vigilant and understand how these schemes typically operate. Look out for promises of unusually high returns with minimal effort or risk. If an investment opportunity requires immediate and large-scale investments with little explanation, it could be a red flag. Scammers often use emotional appeals, pressure tactics, or even falsified documents to lure investors. By staying informed, conducting thorough research, and seeking professional advice, South African investors can protect themselves from falling victim to these fraudulent Ponzi schemes.

In understanding investment fraud, particularly Ponzi schemes in South Africa, recognizing the red flags is key to protecting your financial future. By being aware of the basic structure and learning how to identify these schemes, you can avoid becoming a victim. Stay vigilant, seek professional advice when necessary, and always verify the legitimacy of investment opportunities. Knowing How To Recognise A Ponzi Scheme In South Africa can empower you to make informed decisions and steer clear of fraudulent investments.