In South Africa, identifying Ponzi schemes is crucial for investor protection. Look out for unusually high returns with no apparent risk, a lack of transparency, and pressure to invest quickly. Verify investment legitimacy by researching companies, checking Financial Services Board (FSCA) compliance, reading independent reviews, and avoiding opaque schemes. Diversify investments across legitimate sectors to minimize risk.

In South Africa, where financial opportunities are diverse, investors must remain vigilant against insidious schemes. This article delves into the critical issue of Ponzi Schemes, a sophisticated form of fraud prevalent globally and increasingly targeted at South African investors. Understanding these schemes, specifically within the local context, is paramount to protecting your hard-earned money. Learn effective strategies on how to recognise a Ponzi Scheme in South Africa and avoid becoming a victim.

- Understanding Ponzi Schemes: The South African Context

- Strategies for Recognizing and Avoiding Ponzi Schemes in SA

Understanding Ponzi Schemes: The South African Context

In South Africa, understanding Ponzi schemes is crucial to protecting investors. These fraudulent investment operations promise high returns with little or no risk, luring unsuspecting individuals. However, unlike legitimate investments, returns in a Ponzi scheme are generated solely from new investor funds rather than profit from any actual business or investment activities. Once new investments dry up, the scheme collapses, leaving many investors with significant losses.

To recognise a Ponzi scheme in South Africa, look out for unusual promises of high returns with minimal risk, lack of transparency regarding how funds are invested and used, and pressure to invest quickly without allowing time for proper due diligence. It’s important for potential investors to conduct thorough research on any investment opportunity, verify the track record, and consult with regulated financial advisors before committing their money.

Strategies for Recognizing and Avoiding Ponzi Schemes in SA

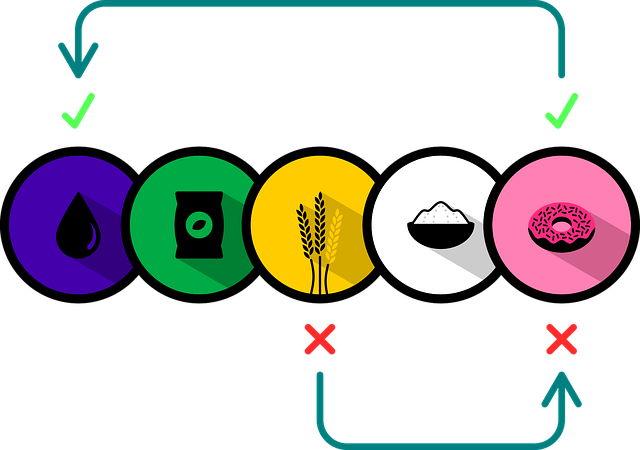

In South Africa, where financial opportunities are diverse, recognizing and avoiding Ponzi schemes is crucial for protecting investors. How to recognise a Ponzi scheme in South Africa involves understanding its key red flags. These include unrealistic or excessive returns promised with little or no risk, a requirement for continuous investment to maintain or increase returns, and pressure to recruit new investors to sustain the operation. Scams often use high-pressure sales tactics, emotional appeals, and elaborate stories to lure victims.

Staying alert and informed is key. Always verify the legitimacy of an investment opportunity by researching the company thoroughly. Check for regulatory compliance with the Financial Sector Conduct Authority (FSCA) and read reviews from independent sources. Avoid investing in schemes that lack transparency or refuse to provide detailed information about how returns are generated. Diversification is another powerful tool; spreading investments across various legitimate sectors reduces the risk of losses if a single scheme fails.

In South Africa, where financial fraud poses a significant risk to investors, understanding how to recognise a Ponzi scheme is paramount. By being vigilant and adopting strategic measures, individuals can protect their investments and avoid becoming victims of these deceptive schemes. Educating oneself about the telltale signs and implementing precautionary steps is key to ensuring financial security in the face of such scams. Remember, staying informed and being proactive are effective ways to safeguard your hard-earned money in South Africa’s investment landscape.