In South Africa, where financial fraud is on the rise, understanding How To Recognise A Ponzi Scheme is crucial for investors. Red flags include unrealistic returns, aggressive sales tactics, lack of legitimate products/services, complex jargon, and pressure to invest swiftly. To protect investments, verify opportunities with regulatory bodies like the NFPA, diversify portfolios, and stay informed about market trends. The Financial Sector Conduct Authority (FSCA) plays a vital role in early detection and loss prevention by educating investors and monitoring financial service providers.

In South Africa, as in many countries, investors are vulnerable to sophisticated financial scams, with Ponzi schemes posing a significant risk. This article equips local investors with the knowledge needed to recognise and avoid these fraudulent schemes. We delve into the fundamentals of Ponzi plans, highlighting key indicators prevalent in SA. By understanding common red flags and implementing preventative strategies, individuals can safeguard their investments. Additionally, we explore South Africa’s regulatory environment and reporting mechanisms, providing valuable insights for informed decision-making. Learn how to recognise a Ponzi scheme in South Africa and protect your financial future.

- Understanding Ponzi Schemes: The Basics

- Red Flags to Look Out For in South Africa

- Safeguarding Your Investments: Actionable Tips

- Regulatory Framework and Reporting Mechanisms in SA

Understanding Ponzi Schemes: The Basics

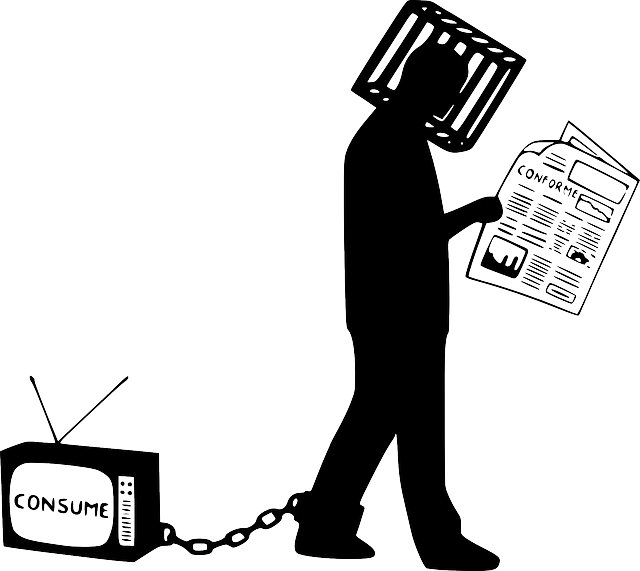

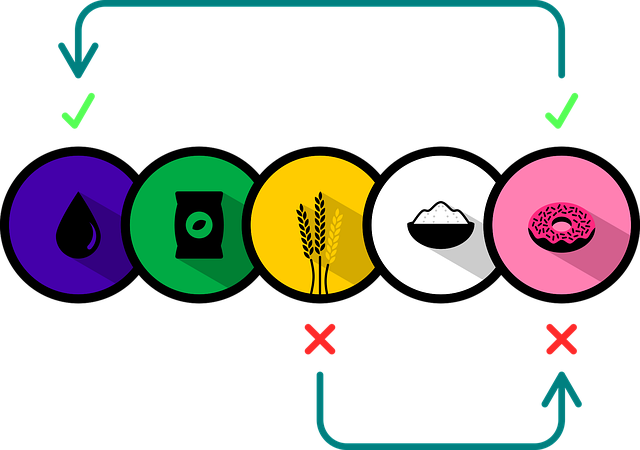

A Ponzi scheme is an investment fraud where returns are paid to existing investors from funds contributed by new investors, rather than from any actual profit earned. It’s a dangerous and illegal practice that promises high returns with little or no risk, luring unsuspecting investors. In South Africa, as in many countries, these schemes can be particularly enticing due to their seemingly quick and easy money-making promises.

To recognise a Ponzi scheme in South Africa, keep an eye out for several red flags. This includes unrealistic investment returns, high pressure sales tactics, no real products or services underlying the investment, and a lack of transparency about how the money is being invested. If an investment opportunity sounds too good to be true, it probably is. Always do thorough research before investing your hard-earned money.

Red Flags to Look Out For in South Africa

In South Africa, where financial fraud is on the rise, it’s crucial for investors to know how to recognise a Ponzi scheme. These schemes often attract investors with promises of high returns with little or no risk, but they lack legitimate revenue streams and rely on new investor funds to pay existing investors. Red flags to look out for include unrealistic investment returns, pressure to invest quickly without proper due diligence, and the use of complex jargon to hide the true nature of the investment.

Additionally, be wary of opportunities that seem too good to be true, lack transparency in operations, or refuse to provide financial statements or third-party audits. It’s essential for South African investors to conduct thorough research on any investment opportunity, verify claims, and consult with regulatory bodies or financial advisors before committing their funds.

Safeguarding Your Investments: Actionable Tips

In the quest to safeguard your investments, it’s paramount to be an informed investor in South Africa. One of the most insidious threats to your financial security is a Ponzi scheme—a fraudulent investment operation promising high returns with little or no risk. Learning how to recognise a Ponzi scheme is a critical step in protecting your hard-earned money.

Look out for unrealistic promises of extraordinary returns, lack of transparency, and pressure to act quickly. These are common red flags indicating a potential scam. Always verify the legitimacy of an investment opportunity by checking registration with relevant authorities like the National Financial Planning Authority (NFPA). Diversification is another powerful tool; avoid putting all your eggs in one basket, especially with unfamiliar investments. Keep abreast of market trends and stay informed about new schemes through trusted sources to make wise decisions.

Regulatory Framework and Reporting Mechanisms in SA

In South Africa, the regulatory framework for financial markets and investments is overseen by various institutions to protect investors, including the Financial Sector Conduct Authority (FSCA). The FSCA plays a pivotal role in monitoring and regulating financial service providers, ensuring they operate within legal boundaries. One of its primary functions is to educate investors on how to recognise fraudulent schemes like Ponzi plans. The FSCA encourages investors to be vigilant and report any suspicious activities or individuals promising unrealistic returns.

Reporting mechanisms are readily available for South African investors. The FSCA has put in place a system where investors can lodge complaints or provide information about potential Ponzi schemes through their official channels. By being proactive in reporting, investors contribute to the early detection of such fraudulent activities, which is key to preventing substantial losses. Staying informed and understanding How To Recognise A Ponzi Scheme In South Africa is a powerful tool for investors to safeguard their financial well-being.

Understanding how to recognise a Ponzi scheme in South Africa is crucial for investors looking to safeguard their hard-earned money. By being vigilant and heeding the red flags discussed, such as unrealistic investment promises, lack of transparency, and early returns with minimal risk, investors can avoid falling victim to these fraudulent schemes. Adopting robust due diligence practices, diversifying investments, and leveraging South Africa’s regulatory frameworks offer effective measures to protect against Ponzi schemes. Remember, staying informed and being proactive are key to ensuring your financial security in the ever-evolving investment landscape.