In South Africa, understanding Ponzi schemes is crucial to protect against fraudulent high-return investment opportunities with minimal risk. Watch for unusual promises, elaborate business models, and lack of transparency. Steps include scrutinizing investments, seeking independent advice, and reporting suspicious activities. By being vigilant, using research, and staying informed, investors can identify and avoid these schemes, safeguarding their financial future in South Africa.

In the dynamic investment landscape of South Africa, understanding potential risks is paramount. This article equips local investors with essential knowledge on spotting Ponzi schemes—a prevalent and insidious form of fraud. We demystify these schemes, highlighting common red flags to watch for. Through practical strategies and real-world case studies, discover how to protect your investments and navigate the market wisely. Learn the art of recognizing Ponzi schemes in South Africa and safeguard your financial future.

- Understanding Ponzi Schemes: The Basics for South African Investors

- Common Red Flags to Look Out For in Potential Investments

- Protecting Yourself: Strategies for Recognizing and Avoiding Ponzi Schemes

- Case Studies: Real-World Examples of Ponzi Scams in South Africa

Understanding Ponzi Schemes: The Basics for South African Investors

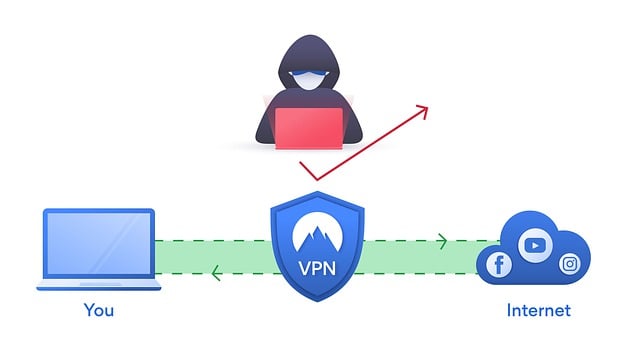

In the world of investing, a Ponzi scheme is a deceptive and illegal investment model that promises high returns with little or no risk. It’s a fraudulent system where new investors’ money is used to pay existing ones, creating the illusion of consistent profits. This scam often targets eager investors who are looking for quick gains, especially in regions like South Africa where financial opportunities might be limited. Understanding how these schemes operate is crucial for South African investors to protect their hard-earned money.

To recognise a Ponzi scheme in South Africa, keep an eye out for unusual investment promises, such as guaranteed high returns with minimal risk or pressure to invest quickly without proper due diligence. Legitimate investments rarely promise extraordinary returns with no effort required. Additionally, be wary of elaborate and unrealistic business models, excessive use of jargon, and a lack of transparency regarding the investment’s inner workings. How To Recognise A Ponzi Scheme In South Africa involves scrutinising the fine print, seeking independent advice, and reporting any suspicious activities to relevant financial authorities.

Common Red Flags to Look Out For in Potential Investments

In South Africa, as with anywhere, knowing how to recognise a Ponzi scheme is crucial for protecting your hard-earned money. While legitimate investments offer a return on investment (ROI) based on real growth and profitability, a Ponzi scheme promises unrealistic returns with minimal risk. Here are some common red flags to watch out for:

Unsustainable High Returns: If an investment opportunity promises unusually high and guaranteed returns, it’s a major cause for concern. Legitimate investments typically have varying degrees of risk associated with them, and high returns often come with higher risks. Be wary of schemes that offer returns that seem too good to be true, especially when they’re promised without any significant effort or risk on your part.

Protecting Yourself: Strategies for Recognizing and Avoiding Ponzi Schemes

Protecting yourself from financial scams, particularly Ponzi schemes, is an essential aspect of responsible investing in South Africa. These fraudulent investments often attract investors with promises of high returns with little or no risk. However, understanding how to recognise one is crucial for avoiding significant losses.

Some key strategies include verifying the legitimacy of investment opportunities by conducting thorough research and seeking professional advice. Stay alert for unrealistic promises of exceptional returns, especially if they come with minimal risk. Be wary of pressure tactics, high-pressure sales pitches, or demands for urgent action, as these are common ploys used to lure unsuspecting investors. It’s important to remember that legitimate investments take time to mature and should not offer immediate substantial gains. Additionally, always ensure transparency in how the investment is structured and managed, and be cautious of secretive or overly complex schemes.

Case Studies: Real-World Examples of Ponzi Scams in South Africa

In recent years, South Africa has seen several high-profile cases of Ponzi schemes, highlighting the need for investors to be vigilant and well-informed. These scams often promise high returns with little or no risk, attracting unsuspecting individuals who are eager to grow their wealth. For instance, a notorious case involved a fraudulent investment fund that promised substantial monthly returns, luring investors with fictional success stories and exaggerated market predictions. Another example was a scheme masquerading as a peer-to-peer lending platform, where investors were lured by seemingly guaranteed returns and a lack of regulatory oversight. These cases demonstrate the sophisticated methods employed by scammers and the importance of understanding how to recognise these fraudulent schemes.

By studying real-world examples, South African investors can learn valuable lessons on spotting Ponzi scams. Key indicators include excessive promises of high returns with little or no risk, lack of transparency in investment strategies, and pressure tactics used to encourage quick decisions. Investors should also be wary of elaborate stories or testimonials that seem too good to be true. Examining historical performance data and seeking independent verifications can help uncover false claims. Additionally, understanding the regulatory environment and staying informed about recent scams through consumer protection agencies is crucial for identifying potential threats.

In the pursuit of lucrative investments, South African investors must remain vigilant against the insidious allure of Ponzi schemes. By understanding the basic structure and common red flags outlined in this article, such as unrealistic returns, lack of transparency, and pressure to invest quickly, individuals can protect their financial well-being. Adopting strategic measures, like diversifying investments and verifying claims independently, is crucial for avoiding these fraudulent practices. Staying informed and being cautious when considering new opportunities are essential steps towards safeguarding one’s savings in the South African investment landscape.